繁

简

EN

Log on

About Us

Financial Services

Business Management

Wealth Management

Premium Travel

Contact Us

Financial Service

Mutual Fund

What is “unit trust” and “mutual fund”?

“Unit trust” means any arrangement made for the purpose, or having the effect, of providing facilities for the participation by persons as beneficiaries under a trust, in profits or income arising from the acquisition, holding, management or disposal of securities or any other property whatsoever.

“Mutual fund” means any arrangement made for the purpose, or having the effect, of providing facilities for investment in shares in a corporation which is or holds itself out as being engaged primarily in the business of investing, reinvesting or trading in securities or any other property whatsoever and which is offering for sale or has outstanding any redeemable shares of which it is the issuer.

A unit trust or a mutual fund refers to a collective investment scheme under which professional fund managers pool money from individual investors and manage it according to pre-set investment objectives. The investment objectives can range from maximizing capital gains to maintaining a stable stream of income, and from beating inflation to preserving capital. Based on the designated objectives, the fund manager will invest the money in equities, bonds, currencies or other relevant investment instruments in a specific market or different markets around the world.

Funds must be authorized by the Securities and Futures Commission before they can be marketed in Hong Kong. They must meet the requirements of the Code on Unit Trusts and Mutual Funds which covers investment restrictions, the eligibility of the fund manager / custodian / trustee, information disclosure and operational policy. However, SFC authorization is not an official recommendation of a fund nor does it guarantee a good return.

What are the advantages and disadvantages of funds investment?

Advantages:

- Many choices, low investment – Normally with an investment of US$1,000 to few thousands USD, investors already can invest in various types of securities and financial products in different markets.

- Professional investment management service – investors can enjoy the services provided by fund managers. Fund managers take out comprehensive research into the performance of individual financial product and look into the market trends, the fundamentals of the economies and other economic issues of the time before making any investment decision.

- Risk diversification – Risk(s) can be diverted by investing in different markets and in a wide range of products. Choose portfolio funds that helps spread the risk, and obtain a better risk return than investing in individual securities.

- Capture global investment opportunities – Investors can choose to invest in local and overseas funds and benefit from global investment opportunities.

- Capital Growth potential – Fund managers help investors to discover investment opportunities and endeavor for better returns.

- Simple procedures – fund purchase procedures are simple. Investors can purchase fund directly from fund companies or through banks, brokerage firms and other independent financial advisors.

Disadvantages:

- Unable to choose stock – fund investment deprives investors of their right to choose stock

- Riskier than bank savings – Most funds have higher risk than bank deposits

- Unable to know real-time fund prices – Investors are unable to know the real-time prices at times of buying and selling. Most funds are daily traded. Investor do not know the actual buy/sell price when they trade or switch in/out of a fund until the next trading day.

General Types of Funds

Commonly, funds can be classified according to their investment objectives and strategies:

- Asset Allocation Fund – This fund is a balanced investment portfolio; the purpose is to obtain capital gain and regular income. This kind of fund normally invests in global stocks, fixed-interests and currency market instruments and the amount of investment in an asset will not exceed one percent usually.

- Equity Fund – Equity fund mainly invests in stock (usually not less than 70%).The purpose is to maximize the capital gains. This kind of funds include both local and international stock investments, as well as some blue chips or small companies shares.

- Bond Fund – Bond fund is mainly invested in bonds or other fixed income securities (usually not less than 70%). Issuers of these bonds and securities include government, municipal states, corporations or any other issuers.

- Money Market Fund – Money Market Funds that invest in short-term money market instrument (usually less than one year), such as government securities, term papers, banks deposits, and other assets dominated in different currencies.

- Warrants and derivatives Fund – Warrant funds usually invest more than 70% of the assets invested in warrants or related financial instruments. This kind of funds can have a high leverage ratio. Derivative fund invests in leveraged financial instruments such as futures, forward contracts and options with the aim of capital appreciation.

- Convertible bond Fund – convertible bond fund predominantly invests in convertible bonds and preferred stocks (usually not less than 70%). Convertible bond is a financial instrument which the bond holders have the right to converse the bonds to stock before the pre-specified date.

- Guaranteed Fund – Guaranteed fund is the type of fund that provides a legal guarantee that limits the loss of an investor to a certain amount over a period of time

- Fund of funds – Fund of funds invest in other funds but not directly in stock, bond and other securities.

Which type of fund has higher risk compared to bank deposits?

The risk and return can differ in types of funds. The more the risk means the higher the return, vice versa. The risk preference of investors is normally decided by their age, income, financial situations, investment objectives and risk tolerance level.

When deciding which fund to invest in, investors should take their age, marital status, income level and financial status into account, so as to measure their ability to bear risk. Investors should always choose the fund(s) that fit their investment objectives and risk preference

What information can investors obtain from the fund companies or intermediaries?

Fund companies or intermediaries will provide information as below:

- Explanatory memorandum or Prospectus

- Latest audited annual report

- Latest semi-annual report that has not been audited

- Application Form

- Other information/ materials that the fund companies and intermediaries think are appropriate

After investing in a fund, investors will receive balance sheet monthly or quarterly, reporting the latest status of fund investment portfolio (including the value of fund assets and the number of units hold). Investors also receive newsletters and reports which report about the market prospective, product/service news and events. These materials must be approved by the Hong Kong Securities and Futures Commission before they are published.

What should be paid attention to when investing a fund?

Before investing in a fund, investor must consider the following factors. Investors must read all the relevant information, such as explanatory memorandum or prospectus, and also the interim and annual reports of the fund issuer.

Personal Situation

- Financial situation

- Investment objectives

- Risk tolerance

Information on Fund Manager

- Reputation of the fund manager

- Total funds under management

- Investment experience and procedures

- After sales service

Fund Information

- Past Performance and record of actual return

- Performance of fund managers

- Whether the fund is suitable for individual needs

What guarantee could a fund offer?

The investment in fund will be separated from other assets of fund managers. The fund transactions are supervised by independent trustees. The Hong Kong Securities and Futures Commission will be responsible for the general supervision.

How to make profit through funds investment?

Investors can make profit in two ways:

- Capital Appreciation – stock and bond appreciation in fund

- Dividend Income – Dividend or interest income paid out from the fund. Dividend can be distributed by cash and be invested in fund. Investors should read issuance prospectus carefully for a clear knowledge of the distribution policy. Normally, fund managers will inform whether there will be dividend distribution. If yes, they will also indicate the frequency and timing of the dividend.

What are the major charges for fund investment?

Charges to investors include subscription fees and redemption fees. The fees to be covered by the fund include management fees, performance fees and trustee fees. The fees can be found in the offering documents of funds.

Source: Hong Kong Investment Funds Association

Risk Disclosure Statement

Investors must pay attention to risks involved in an investment. The Unit price of a fund may go up or down. The track record presented does not indicate similar performance(s) in the future. Before making any investment decisions, the investors should read the fund’s offering document carefully (including the risk factors involved, especially the risk factors of investing in emerging markets).

The risk of buying and selling mutual funds

Fees and Charges

Types of fund

Initial Subscription Fee

Annual Management Fee

Redemption fee/Performance fee

Currency market

Bond

Security

Warrant

Remarks:

0% - 2%

3% - 5%

5% - 6%

5% - 7%

Included in selling price

(some fund companies may charge higher or lower than the above range)

0.25% - 1%

0.5% - 1.5%

1.0% - 2.0%

1.5% - 2.5%

Calculated daily and deducted from fund; No actual payment

(some fund companies may charge higher or lower than the above range)

The more complicated

investment instruments

results in higher charges

Only some fund companies would charge redemption fee or performance fee

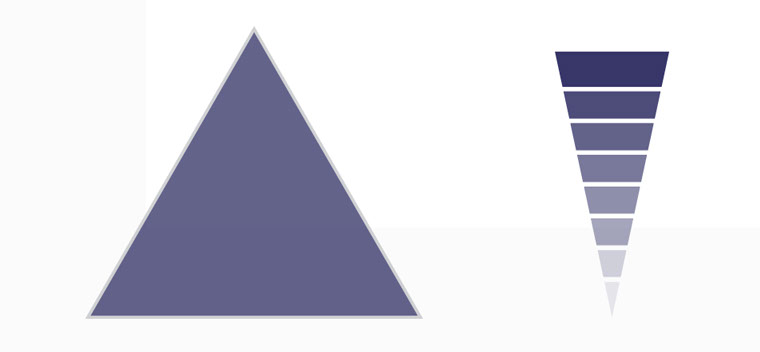

Higher Risk, Higher Return

Derivatives fund

Region equity fund

International bond fund

Single country equity fund

International equity fund

Money market fund

Bank deposit

Lower Risk, Lower Return

Risk of buying/ selling funds

The price of funds may fluctuate, drastically sometimes. The fund prices can rise or fall, or even become worthless. Investing in particular fund(s) may incur losses rather than generating profits. Before making any decision, the investors should read the prospectus and other sale documents carefully and look through the latest updates about relevant investment fund.

Emerging Market Funds

Market Risk

Every investment fund has unique investment focus. Customers should know their own investment objectives, strategies and relative risk levels to make sure that the investment fund suits their financial situation and investment objectives.

Country Risk

The government may intervene the market by foreign exchange control policy or limiting the foreign exchange profit redemption, and these may affect the value of the investment or the ability of the investor to gain profit.

Hedge Fund/ Alternative Investment Fund

Investment Strategy Risk

Hedge funds or alternative investment funds are the funds that use derivatives to make directional investment and/or permitted to short selling and/or using significant leverage through borrowing. The strategies of this type of fund normally have high risk. Due to the leverage ratio, a slight movement in the market may bring large profit. Similarly, significant loss may be incurred too, which the customers could possibly lose the entire amount of his/ her investment under some circumstances.